So if I want to get a copy of my DD214 or I want to get a copy of a loved one's key to 14 due to burial or something like that what is fastest way to do it okay so there's um it's the same way you go online and use our application evap Rex you go to the National Archives webpage which is archives.gov click on military service records and then look for our application called evat Rex to submit a request online you made a distinction in your question between you know I'm looking for my DD214 but then you also said what if I need a DD214 to support a funeral service right okay when you're on that application you can request expedited service and you'll be asked why and if it's a medical emergency or burial homeless veteran seeking shelter that sort of thing we will expedite that request and you know with burials we turn those around in two three days sometimes we'll always try to meet the date that is required for the service also if it's a national cemetery what I advise families you know grieving families don't need to be burdened with navigating the federal bureaucracy right let the national cemetery scheduling office do it for you they deal directly with us on records and we get hundreds every single day connect with the benefits you earned and deserve visit news.va.gov for current events sign up for the vet resources e-newsletter subscribe on YouTube for Content like the sit rep and vr5 or follow VA on social media visit the video description below and get connected today.

PDF editing your way

Complete or edit your dd215 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export dd form 215 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your dd215 form pdf as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your dd215 form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

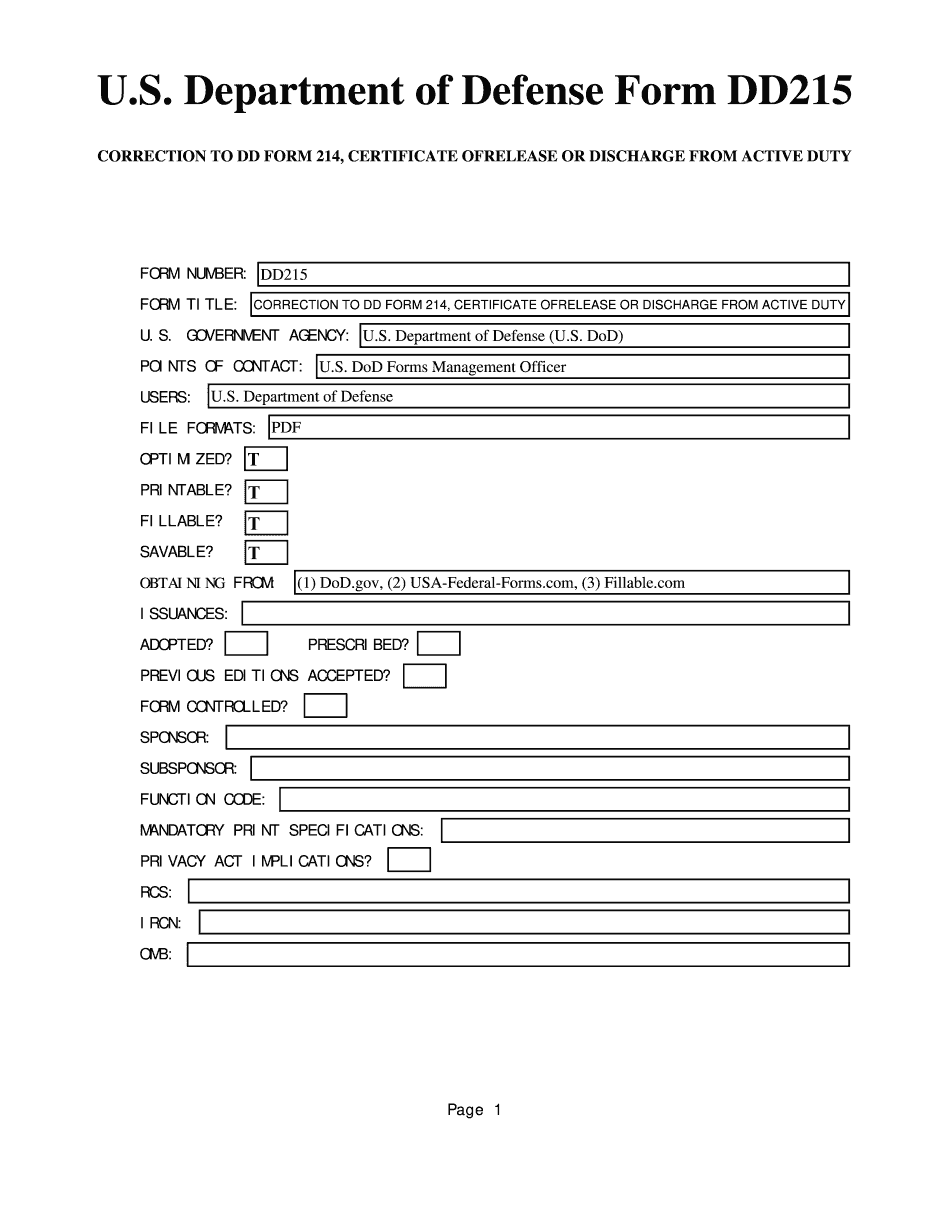

What you should know about DD215 Form

- Form Number: DD215

- Form Title: Correction to DD Form 214 Certificate of Release or Discharge from Active Duty

- Agency: U.S. Department of Defense

Award-winning PDF software

How to prepare DD215 Form

About Form Dd215 Form

Form DD215 is a correction to DD214, which is the Certificate of Release or Discharge from Active Duty. It is used to correct errors or add information to the DD214. Anyone who has been discharged or separated from the military and received a DD214 may need a DD215 if there are errors or missing information on the original form that needs to be corrected. It is important to have an accurate DD214 for benefits eligibility and retirement purposes.

How to complete a DD215 Form

- Obtain the form from DoDgov, USAFederalFormscom, or Fillablecom

- Open the PDF form in a compatible reader

- Fill out the form by typing in your information in the fillable fields

- Save the filledout form for your records

- Print a copy if needed

- Remember to keep a copy of the completed form for your records

People also ask about DD215 Form

What people say about us

It's a smart idea to send forms on-line

Video instructions and help with filling out and completing DD215 Form